Disclosure: I received this product free through the Homeschool Review Crew.

It's been quite a year already, and with so much happening in our markets (Gamestop, anyone?) you may have kids asking about the economy. It's also really important that they get budgeting down before they leave the house, so I was super thrilled to have a chance to review PersonalFinanceLab Budgeting Game, Stock Market Game, and integrated curriculum with my 14-year-old. Get the details of this unique program from PersonalFinanceLab, and decide if it's right for you!

What is PersonalFinanceLab?

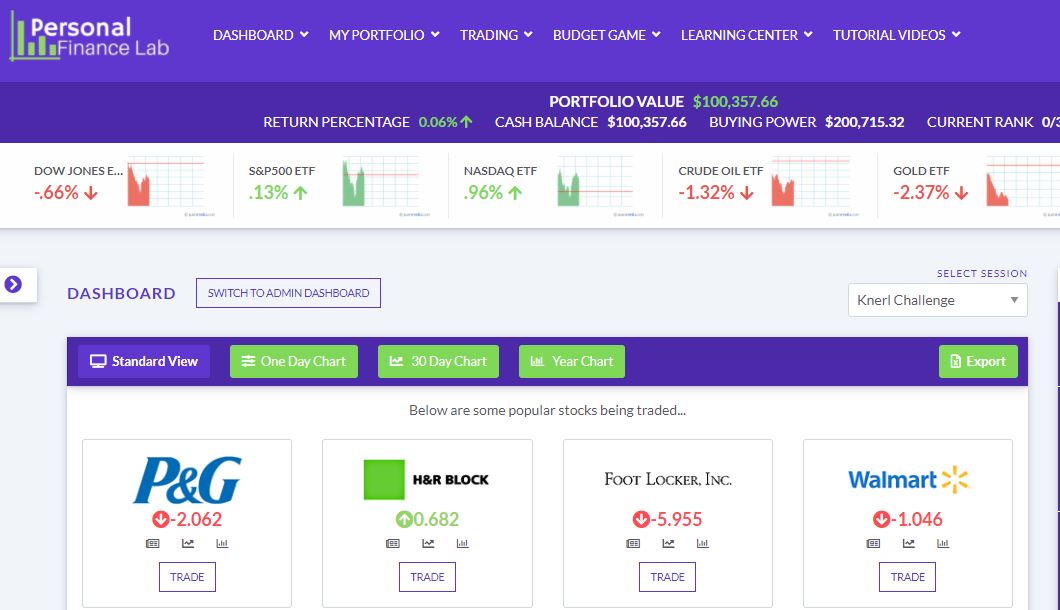

An all-in-one budgeting game, stock market game, and educational curriculum, PersonalFinanceLab seeks to solve the growing crisis in our country: a lack of financial literacy. With a dashboard that teachers or parents can use to create new "challenges," kids can be invited to participate. Teachers check on progress, seeing how individual students are doing, as well as assigning new learning modules to be watched. Parents or teachers can see who's leading (or "winning"), if competition is an aspect you want to nurture with this tool.

How do you set it up?

I will not lie. When I first saw the platform, I was intimidated. There is a lot of information, but the good news is that you'll get access to some resources to help. I admittedly didn't view a lot of the supporting materials and just jumped in to see what it would be like for someone who nothing about the program. Setting it up took about 15-20 minutes. I created a challenge, invited my students, and set a few things like trading rules. Then, we were off!

What do kids learn?

I'll let you read a bit about what my son thinks about this program (hint: he's a huge fan!), but first, I want to point out some cool features. Since there is so much included in this platform, it can be hard to know what you're getting out of it without using it fully, including 300 lessons, activities, quizzes, and calculators that follow National and State standards. So, let me summarize:

1) The program offers an authentic budgeting experience that looks and feels like using any software-based budgeting program on the market today. Kids get a set amount of money, things happen, they have to pay bills, anyway. They can tweak their spending to make all of their money last. Or not. But they see what happens and how it affects other areas of their financial life.

2) Budgeting concepts are covered through digital lessons. These brief yet engaging videos walk kids though core financial definitions and help lay that formal groundwork that we all want from a financial literacy program. For those who want to check boxes off your list and say "my kid learn about discretionary income" -- here you go!

3) The gaming aspect is intense -- and fun. Kids log on, see how their stocks did, check their budgets, and participate in activities that mimic real-life. Every action as a consequence (good or bad.) Kids learn early on that managing money takes work.

I wasn't really sure what my child would think of this program. To me, it seemed really complicated. My 14-year-old loves simulation games, however, and he's really into those computer programs where you have to keep your "resources" at the right level to keep your game going well. Because he has grown up with these games, this program was an excellent fit. I didn't really have to explain much to him, and he started using the PersonalFinanceLab tools in lieu of video games -- which I think is probably the coolest part!

Here is what my 14-year-old son thought of the program (his own words):

I like the convenience of the popup questions, and they have taught me a lot -- they are short and sweet. I like that.

It gives real-time news and

The tips are useful. The badges add a form of encouragement that is needed when there is so much to do already.

Actually, budgeting is not difficult to understand IF you watch the videos and read the

Questions. Stock is riskier for me and I don’t understand it as well. But the news is useful. I liked how simple the budget game is.

You jump in right away -- like real life -- but that’s

GOOD. I felt stressed that I would mess up and ruin everything, but it is difficult to start in real life (so that was a green light for me.)

The UI for the budget game is nice. Again, watching the videos is very important for good understanding. There is a useful calculator, if your feeling like using it; it's just a small pop out on the right side.

The options for the end of the week are important. I didn’t realize until I made a credit card mistake that the extra income option was useful. When I neglected the household chores option, it kept asking me to pay much more money than would be necessary. I neglected socialization the most, which hurt me in the business area, but since I focused more so on professional development, it counteracted the lack of social time."

My really enjoyed this program. He played the budget game daily and also spent an hour or more watching videos and adjusting his portfolio. While he did take longer to get into the stocks/trading aspect, he had fun with it. Did he have any complaints? According to him, "As I was going through the budget game, the taxes for "Where You Live" bugged out for me (or maybe I misunderstood something)."

How can you use this in your homeschool?

There are many ways to incorporate this into your learning. As a stand-alone curriculum, it could be a financial lit or even an beginning economics course. You can just play the games. You can just use the lessons (but I highly recommend using both!) Each virtual "month" takes 20 minutes, which is how my son got through 7 months of budgeting in just one week!

Ideally, you could use this as a 2-3x a week class, taking no more than 30-45 minutes for the lesson, games, and any discussion or questions.

Summary

This is the FIRST thing my son does when he gets up in the morning. If you have a child that needs to learn budgeting skills or is fascinated with what's happening around stocks in the news, I have a feeling they will love Personal Finance Lab.

If you have been putting off financial literacy learning because you don't have time, this tool pretty much handles itself once you set up the challenge and rules. Yes, you should check in on your child and make sure they are progressing through the assignments (you can assign them as you wish or let them just go through at their own pace). Yes, you should see what's up if you see their simulated credit score tank (which is a good lesson, by the way.)

This program is no replacement for conversations with your child about money, money mistakes, and good management practices. It can, however, really light a spark that may not have been there and also offer a tool for busy parents that's much easier to administer than workbooks. I'm really grateful we found this tool. My son now has his brothers joining him to see if they can beat the stock market!

More info:

Learn about this program at the following sites:

Comments

Post a Comment